What is a Cabela's credit card?

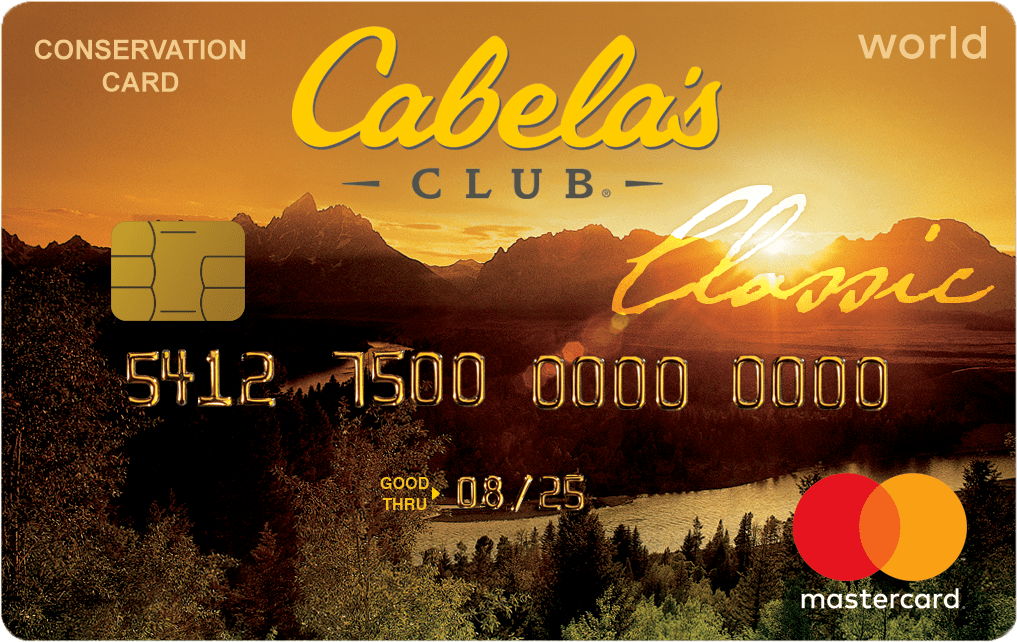

A Cabela's credit card is a store-branded credit card that can be used to make purchases at Cabela's retail stores and online. Cabela's credit cards are issued by Synchrony Bank and come with a variety of benefits, including:

- Earn points on every purchase that can be redeemed for Cabela's merchandise, gift cards, and travel.

- Get exclusive discounts and financing offers on Cabela's products and services.

- Enjoy a dedicated customer service line for Cabela's credit cardholders.

Cabela's credit cards are a great way to save money on your outdoor purchases and earn rewards on your everyday spending.

Read also:Get The Latest On Vegamovies20 Your Source For Blockbusters

Benefits of a Cabela's Credit Card

There are many benefits to having a Cabela's credit card, including:

- Earn points on every purchase: You can earn points on every purchase you make with your Cabela's credit card, whether you're shopping in-store or online. These points can be redeemed for Cabela's merchandise, gift cards, and travel.

- Get exclusive discounts and financing offers: Cabela's credit cardholders can get exclusive discounts and financing offers on Cabela's products and services. This can save you money on your outdoor purchases.

- Enjoy a dedicated customer service line: Cabela's credit cardholders have access to a dedicated customer service line. This can be helpful if you have any questions or concerns about your account.

How to Apply for a Cabela's Credit Card

You can apply for a Cabela's credit card online or in-store. To apply online, visit the Cabela's website and click on the "Credit Card" link. You will need to provide some basic information, including your name, address, and Social Security number. You will also need to provide your income and employment information. Once you have completed the application, you will need to submit it for approval.

Conclusion

A Cabela's credit card is a great way to save money on your outdoor purchases and earn rewards on your everyday spending. If you are a frequent Cabela's shopper, then a Cabela's credit card is a must-have.

Read also:Dina Merrill A Look Into Her Marriages Famous Spouses

Cabela's Credit Card

The Cabela's Credit Card offers a range of benefits and features that cater to outdoor enthusiasts and frequent Cabela's shoppers. Here are six key aspects to consider:

- Rewards: Earn points on purchases redeemable for merchandise, gift cards, and travel.

- Discounts: Get exclusive discounts and financing offers on Cabela's products and services.

- Convenience: Apply online or in-store, and enjoy dedicated customer service.

- Partnerships: Cabela's has partnered with Visa, Mastercard, and Synchrony Bank for card issuance.

- Eligibility: Subject to credit approval, with factors like income and credit history considered.

- Fees: May include an annual fee, interest charges, and balance transfer fees.

These aspects combine to make the Cabela's Credit Card a valuable tool for maximizing savings, earning rewards, and enhancing the overall shopping experience at Cabela's. Whether you're planning a hunting or fishing expedition, upgrading your outdoor gear, or simply stocking up on supplies, the Cabela's Credit Card offers a convenient and rewarding way to make your purchases.

1. Rewards

The Cabela's Credit Card offers a rewarding loyalty program that allows cardholders to earn points on every purchase. These points can be redeemed for a wide range of rewards, including Cabela's merchandise, gift cards, and travel. This makes the Cabela's Credit Card a valuable tool for outdoor enthusiasts and frequent Cabela's shoppers who want to maximize their savings and earn rewards on their purchases.

One of the key benefits of the Cabela's Credit Card rewards program is its flexibility. Cardholders can choose to redeem their points for merchandise, gift cards, or travel, depending on their needs and preferences. This flexibility makes the rewards program more valuable, as cardholders can tailor their redemptions to their specific interests and spending habits.

For example, a cardholder who is planning a hunting or fishing trip can redeem their points for Cabela's merchandise, such as new gear or equipment. Alternatively, a cardholder who is looking to save money on their next vacation can redeem their points for a gift card to a hotel or airline. The Cabela's Credit Card rewards program also offers a variety of travel redemption options, including flights, hotel stays, and rental cars. This makes it easy for cardholders to use their points to offset the cost of their next adventure.

Overall, the Cabela's Credit Card rewards program is a valuable feature that can help cardholders save money and earn rewards on their outdoor purchases. The flexibility of the program makes it a great choice for a wide range of cardholders, from those who are just starting to explore the outdoors to those who are avid hunters and fishermen.

2. Discounts

The exclusive discounts and financing offers available with the Cabela's Credit Card are a significant advantage for cardholders. These perks enhance the value of the card, making it an even more attractive option for outdoor enthusiasts and frequent Cabela's shoppers.

The discounts offered through the Cabela's Credit Card can save cardholders money on a wide range of Cabela's products and services, including hunting and fishing gear, camping equipment, and outdoor apparel. These discounts can be applied to both in-store and online purchases, making it easy for cardholders to save money on their outdoor essentials.

In addition to discounts, the Cabela's Credit Card also offers exclusive financing offers on Cabela's products and services. These financing offers can help cardholders spread out the cost of their purchases over time, making it easier to budget for big-ticket items like a new hunting rifle or fishing boat.

The combination of discounts and financing offers makes the Cabela's Credit Card a valuable tool for outdoor enthusiasts who want to save money on their purchases. Whether you're planning a hunting or fishing trip, upgrading your outdoor gear, or simply stocking up on supplies, the Cabela's Credit Card can help you save money and get the most out of your outdoor experiences.

3. Convenience

The convenience offered by the Cabela's Credit Card is a key factor contributing to its popularity among outdoor enthusiasts and frequent Cabela's shoppers. The ability to apply online or in-store, coupled with dedicated customer service, enhances the overall experience and makes it easy for cardholders to manage their accounts and maximize the benefits of the card.

- Online and In-Store Application:Applying for the Cabela's Credit Card is a hassle-free process, with options to apply online or in-store. The online application is straightforward and can be completed in a matter of minutes, while the in-store application allows for immediate assistance from knowledgeable staff who can guide applicants through the process.

- Dedicated Customer Service:Cabela's Credit Card holders have access to dedicated customer service, ensuring prompt and personalized assistance. Cardholders can contact customer service via phone, email, or online chat, and can expect prompt and courteous. This dedicated support enhances the overall cardholder experience and ensures that any questions or concerns are addressed efficiently.

The convenience offered by the Cabela's Credit Card extends beyond the application process, as cardholders can easily manage their accounts online or through the mobile app. This includes viewing statements, making payments, and redeeming rewards. The mobile app also provides quick access to exclusive offers and promotions, making it even easier for cardholders to take advantage of the benefits associated with the card.

4. Partnerships

The partnerships between Cabela's and major credit card companies like Visa, Mastercard, and Synchrony Bank play a crucial role in the issuance and operation of the Cabela's Credit Card. These partnerships enable Cabela's to offer its customers a secure and convenient payment method, while also leveraging the extensive networks and expertise of these financial institutions.

One of the key benefits of these partnerships is the widespread acceptance of the Cabela's Credit Card. Visa and Mastercard are two of the most widely accepted credit card networks globally, with millions of merchants accepting their cards. This means that Cabela's Credit Card holders can use their cards to make purchases at a vast range of retail stores, restaurants, and online retailers.

Synchrony Bank, as the issuer of the Cabela's Credit Card, is responsible for managing the credit accounts, processing transactions, and providing customer service to cardholders. Synchrony Bank has extensive experience in the credit card industry and is known for its innovative products and services. By partnering with Synchrony Bank, Cabela's can offer its customers a range of credit options and benefits, such as rewards programs, financing offers, and fraud protection.

Overall, the partnerships between Cabela's, Visa, Mastercard, and Synchrony Bank are essential to the success and functionality of the Cabela's Credit Card. These partnerships enable Cabela's to offer its customers a convenient, secure, and rewarding payment solution that meets their diverse financial needs.

5. Eligibility

The eligibility criteria for the Cabela's Credit Card, which include credit approval and a review of factors like income and credit history, play a significant role in determining an applicant's eligibility for the card. These criteria are in place to ensure responsible lending practices and to assess the applicant's ability to repay the debt.

When an individual applies for the Cabela's Credit Card, their credit history and income are two key factors that are evaluated. Credit history provides insight into an applicant's past borrowing and repayment behaviour, which helps lenders assess the likelihood of future repayment. Income, on the other hand, is an indicator of an applicant's ability to make regular payments on the credit card balance.

By considering these factors, Cabela's can make informed decisions about who to extend credit to and what credit limits to offer. This process helps to minimize the risk of defaults and ensures that the Cabela's Credit Card is offered to responsible borrowers who are likely to use it wisely.

6. Fees

Fees are an important aspect of the Cabela's Credit Card. It's crucial to be aware of these fees to make informed decisions about using the card and managing your finances effectively.

- Annual Fee

The Cabela's Credit Card may have an annual fee, which is a charge assessed each year for the use of the card. This fee can vary depending on the specific card and the cardholder's creditworthiness. It's important to factor in the annual fee when evaluating the overall cost of the card and whether it aligns with your spending habits and financial goals.

- Interest Charges

Interest charges are applied to the unpaid balance on your Cabela's Credit Card. The interest rate is a percentage of the outstanding balance and is typically calculated daily. Interest charges can accumulate over time, especially if you carry a balance on your card. It's essential to make at least the minimum payment each month to avoid late fees and minimize interest charges.

- Balance Transfer Fees

Balance transfer fees may apply if you transfer an existing balance from another credit card to your Cabela's Credit Card. This fee is typically a percentage of the transferred amount. Balance transfers can be useful for consolidating debt and potentially securing a lower interest rate, but it's important to consider the associated fees and whether the savings outweigh the costs.

Understanding the fees associated with the Cabela's Credit Card is crucial for making informed decisions. By carefully considering these fees, you can optimize your use of the card, avoid unnecessary charges, and manage your finances responsibly.

FAQs about Cabela's Credit Card

This section addresses frequently asked questions about the Cabela's Credit Card to provide comprehensive information for prospective and current cardholders.

Question 1: What are the benefits of using the Cabela's Credit Card?

The Cabela's Credit Card offers a range of benefits, including rewards points on purchases, exclusive discounts and financing offers on Cabela's products and services, and dedicated customer service. Cardholders can earn points that can be redeemed for merchandise, gift cards, and travel, and enjoy savings on outdoor gear and equipment.

Question 2: How do I apply for the Cabela's Credit Card?

You can apply for the Cabela's Credit Card online or in-store. The application process involves providing personal and financial information, and your creditworthiness will be evaluated before a decision is made.

Question 3: What are the eligibility criteria for the Cabela's Credit Card?

To be eligible for the Cabela's Credit Card, you must meet certain criteria, including having a good credit history and sufficient income to make regular payments. Factors such as your credit score, debt-to-income ratio, and employment status will be considered during the application review process.

Question 4: Are there any fees associated with the Cabela's Credit Card?

Yes, there may be fees associated with the Cabela's Credit Card, such as an annual fee, interest charges on unpaid balances, and balance transfer fees. It's important to carefully review the terms and conditions of the card to understand all applicable fees.

Question 5: How can I manage my Cabela's Credit Card account?

You can manage your Cabela's Credit Card account online or through the mobile app. This allows you to view your balance, make payments, redeem rewards, and access account statements. You can also contact customer service for assistance with any questions or concerns.

Understanding these FAQs can help you make informed decisions about using the Cabela's Credit Card. By taking advantage of the benefits, understanding the eligibility criteria, being aware of any fees, and managing your account responsibly, you can maximize the value of your Cabela's Credit Card and enhance your shopping experience.

Conclusion

The Cabela's Credit Card offers a comprehensive suite of benefits and features tailored to outdoor enthusiasts and frequent Cabela's shoppers. With its rewards program, exclusive discounts, and convenient account management options, the card provides significant value and enhances the overall shopping experience.

In exploring the various aspects of the Cabela's Credit Card, this article has highlighted its key advantages, eligibility criteria, and potential fees. By understanding these factors, prospective cardholders can make informed decisions about applying for and using the card to maximize its benefits and align with their financial goals.

The Cabela's Credit Card remains a valuable tool for outdoor enthusiasts seeking to save money, earn rewards, and enjoy exclusive perks on their purchases. As the company continues to evolve and expand its product offerings, the Cabela's Credit Card is poised to maintain its relevance and provide even greater value to its cardholders.