If you're an investor interested in the space industry, then you've likely heard of SpaceX. But what is SpaceX stock price, and why is it important?

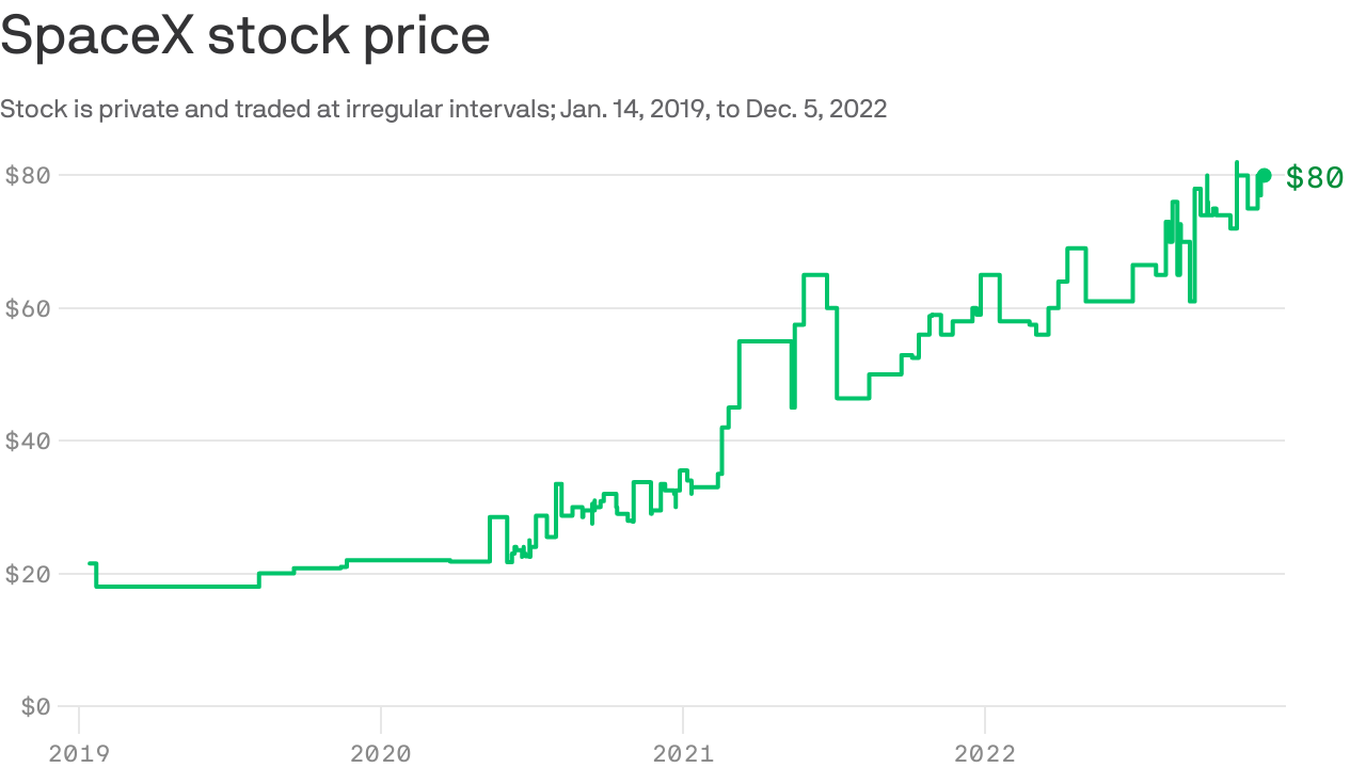

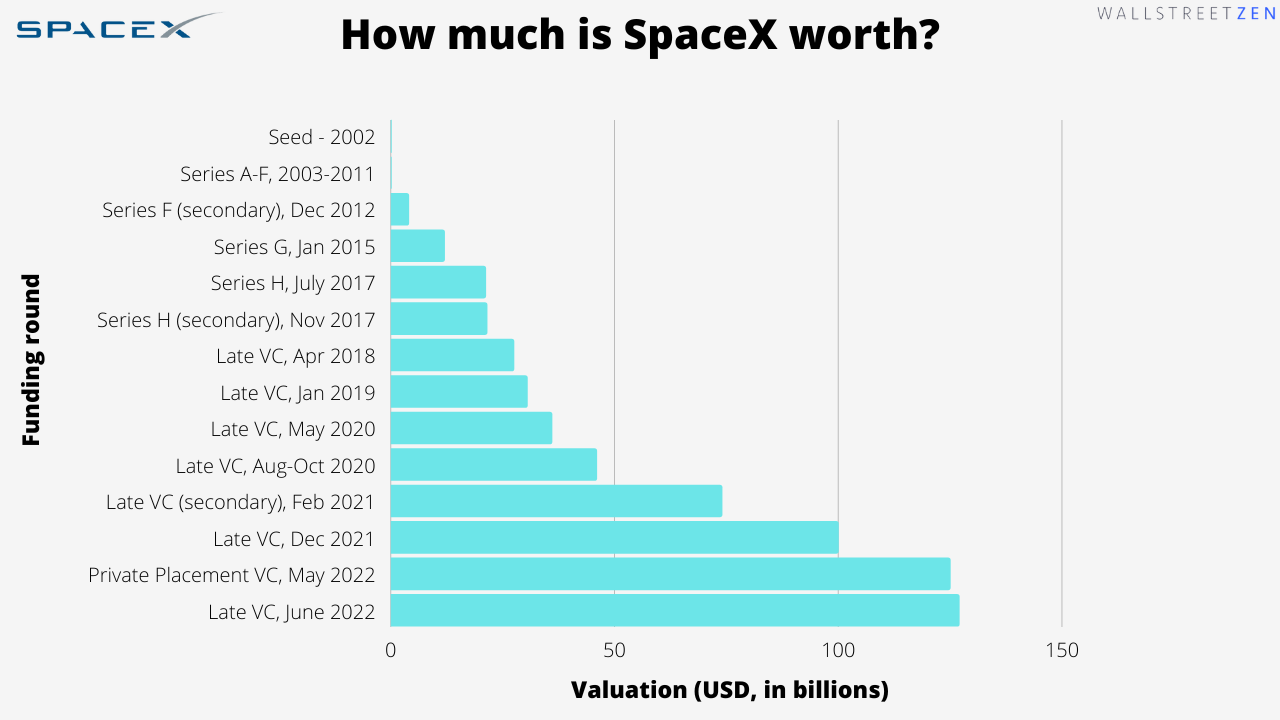

SpaceX is a private company, so its stock is not publicly traded. However, there are a number of ways to invest in SpaceX, such as through private equity or venture capital. The company's stock price has been on a steady upward trend in recent years, as SpaceX has successfully developed and launched a number of rockets and spacecraft.

There are a number of reasons why SpaceX stock is considered a good investment. First, the company is a leader in the space industry. It has developed a number of innovative technologies, such as reusable rockets and spacecraft. This gives SpaceX a competitive advantage over its rivals. Second, the space industry is growing rapidly. As more and more businesses and governments look to use space for commercial and scientific purposes, the demand for SpaceX's products and services is likely to increase. Third, SpaceX has a strong management team. The company's founder and CEO, Elon Musk, is a visionary leader with a proven track record of success.

Read also:Bi Rains Movies And Tv Shows A Comprehensive Guide

Of course, there are also some risks associated with investing in SpaceX. The space industry is a risky business, and there is always the potential for accidents or delays. Additionally, SpaceX is a private company, so there is less information available about its financial performance than there would be if it were a publicly traded company.

Overall, SpaceX stock is a good investment for those who are willing to take on some risk. The company is a leader in the space industry, and its stock price has been on a steady upward trend in recent years. However, investors should be aware of the risks involved before investing in SpaceX.

SpaceX Stock Price

SpaceX is a private company that develops, manufactures, and launches rockets and spacecraft. It was founded in 2002 by Elon Musk with the goal of reducing the cost of space travel and making it more accessible. SpaceX has made significant progress towards this goal, and its stock price has reflected this success.

- Growth: SpaceX's stock price has grown steadily in recent years as the company has successfully developed and launched a number of rockets and spacecraft.

- Leadership: SpaceX is a leader in the space industry, and its stock price reflects the company's strong position in the market.

- Innovation: SpaceX has developed a number of innovative technologies, such as reusable rockets and spacecraft, which give it a competitive advantage over its rivals.

- Demand: The demand for SpaceX's products and services is growing as more and more businesses and governments look to use space for commercial and scientific purposes.

- Management: SpaceX has a strong management team led by Elon Musk, a visionary leader with a proven track record of success.

- Risk: Investing in SpaceX stock is not without risk. The space industry is a risky business, and there is always the potential for accidents or delays.

- Private: SpaceX is a private company, so there is less information available about its financial performance than there would be if it were a publicly traded company.

- Potential: SpaceX has the potential to continue to grow and succeed in the future. The company is well-positioned to benefit from the growing demand for space-based products and services.

Overall, SpaceX stock is a good investment for those who are willing to take on some risk. The company is a leader in the space industry, and its stock price has been on a steady upward trend in recent years. However, investors should be aware of the risks involved before investing in SpaceX.

1. Growth

The growth of SpaceX's stock price is directly tied to the company's success in developing and launching rockets and spacecraft. SpaceX has a number of competitive advantages that have allowed it to succeed in this market, including its innovative technologies, such as reusable rockets and spacecraft, and its strong management team led by Elon Musk.

- Innovation: SpaceX has developed a number of innovative technologies that have given it a competitive advantage in the space industry. These technologies include reusable rockets and spacecraft, which reduce the cost of space travel. SpaceX is also developing new technologies, such as Starship, which is designed to be a reusable spacecraft that can travel to Mars.

- Management: SpaceX has a strong management team led by Elon Musk. Musk is a visionary leader with a proven track record of success. He has been instrumental in SpaceX's success, and his leadership is a key reason why the company's stock price has grown steadily in recent years.

- Demand: The demand for SpaceX's products and services is growing. More and more businesses and governments are looking to use space for commercial and scientific purposes. This is creating a strong demand for SpaceX's rockets and spacecraft, which is driving up the company's stock price.

Overall, the growth of SpaceX's stock price is a reflection of the company's success in the space industry. SpaceX has a number of competitive advantages that have allowed it to succeed in this market, and the company is well-positioned to continue to grow in the future.

Read also:Discover The Stars Alisters Residing In Los Angeles

2. Leadership

SpaceX's leadership is a key factor in the company's success and its stock price reflects this. The company has a strong management team led by Elon Musk, who is a visionary leader with a proven track record of success. Musk has been instrumental in SpaceX's success, and his leadership is a key reason why the company's stock price has grown steadily in recent years.

- Innovation: SpaceX is constantly innovating and developing new technologies, which gives it a competitive advantage in the space industry. The company's reusable rockets and spacecraft are a prime example of this innovation, and they have helped to reduce the cost of space travel. SpaceX is also developing new technologies, such as Starship, which is designed to be a reusable spacecraft that can travel to Mars.

- Execution: SpaceX has a proven track record of success in executing its plans. The company has successfully developed and launched a number of rockets and spacecraft, and it has a number of ambitious plans for the future. SpaceX's execution is a key reason why investors are confident in the company and its stock price.

- Market Position: SpaceX is a leader in the space industry, and it has a strong market position. The company has a number of competitive advantages, such as its innovative technologies and its strong management team. SpaceX is well-positioned to continue to grow and succeed in the future, and its stock price reflects this.

Overall, SpaceX's leadership is a key factor in the company's success and its stock price reflects this. The company has a strong management team led by Elon Musk, who is a visionary leader with a proven track record of success. SpaceX is constantly innovating and developing new technologies, and it has a proven track record of success in executing its plans. SpaceX is a leader in the space industry, and it has a strong market position. The company is well-positioned to continue to grow and succeed in the future, and its stock price reflects this.

3. Innovation

Innovation is a key driver of SpaceX's success and its stock price. The company's reusable rockets and spacecraft are a prime example of this innovation, and they have helped to reduce the cost of space travel. SpaceX is also developing new technologies, such as Starship, which is designed to be a reusable spacecraft that can travel to Mars.

- Reduced Costs: SpaceX's reusable rockets and spacecraft have significantly reduced the cost of space travel. This has made it more affordable for businesses and governments to launch satellites and other payloads into orbit. The reduced costs have also made it possible for SpaceX to offer new services, such as satellite internet and space tourism.

- Increased Reliability: SpaceX's reusable rockets and spacecraft are also more reliable than traditional rockets. This is because they have been designed to be reused multiple times, which reduces the risk of failure. The increased reliability has made SpaceX a more attractive option for businesses and governments that need to launch critical payloads into orbit.

- Competitive Advantage: SpaceX's innovative technologies give it a competitive advantage over its rivals. The company is the only one that has successfully developed and launched reusable rockets and spacecraft. This gives SpaceX a significant cost advantage and allows it to offer more competitive prices to its customers.

Overall, SpaceX's innovation is a key driver of its success and its stock price. The company's reusable rockets and spacecraft have reduced the cost of space travel, increased reliability, and given SpaceX a competitive advantage over its rivals. SpaceX is well-positioned to continue to innovate and develop new technologies in the future, which will further drive its success and its stock price.

4. Demand

The growing demand for SpaceX's products and services is a key driver of the company's success and its stock price. More and more businesses and governments are looking to use space for commercial and scientific purposes, and SpaceX is well-positioned to meet this demand.

- Satellite Internet: SpaceX is developing a satellite internet constellation called Starlink. Starlink will provide high-speed internet access to remote areas that are not currently served by traditional internet providers. Starlink is expected to be a major revenue generator for SpaceX in the future, and it is one of the reasons why the company's stock price is growing.

- Space Tourism: SpaceX is also developing a space tourism business. The company plans to offer flights to space for private individuals and groups. Space tourism is a potentially lucrative market, and it is another reason why investors are bullish on SpaceX's stock.

- Government Contracts: SpaceX has a number of government contracts to launch satellites and other payloads into orbit. These contracts are a major source of revenue for SpaceX, and they are another reason why the company's stock price is growing.

Overall, the growing demand for SpaceX's products and services is a key driver of the company's success and its stock price. SpaceX is well-positioned to meet this demand, and the company has a number of ambitious plans for the future. SpaceX's stock price is likely to continue to grow as the company executes on its plans and becomes a major player in the space industry.

5. Management

The strength of SpaceX's management team is a key factor in the company's success and its stock price. Elon Musk, the company's founder and CEO, is a visionary leader with a proven track record of success. He has been instrumental in SpaceX's success, and his leadership is a key reason why the company's stock price has grown steadily in recent years.

- Innovation: Musk is a visionary leader who is constantly pushing the boundaries of what is possible. He has been instrumental in developing SpaceX's innovative technologies, such as reusable rockets and spacecraft. These technologies have given SpaceX a competitive advantage in the space industry and have helped to drive up the company's stock price.

- Execution: Musk is also a highly effective executor. He has a proven track record of taking ambitious ideas and turning them into reality. This has been essential to SpaceX's success, as the company has had to overcome a number of challenges in order to achieve its goals.

- Team Building: Musk has also been successful in building a strong management team. SpaceX has a team of experienced and talented engineers and executives who are committed to the company's mission. This team has been essential to SpaceX's success, and it is a key reason why the company's stock price has grown steadily in recent years.

- Long-Term Vision: Musk has a long-term vision for SpaceX. He wants to make space travel more accessible and affordable, and he believes that SpaceX can play a major role in making this happen. This long-term vision is inspiring to investors, and it is another reason why the company's stock price has grown steadily in recent years.

Overall, the strength of SpaceX's management team is a key factor in the company's success and its stock price. Elon Musk is a visionary leader who is constantly pushing the boundaries of what is possible. He has been instrumental in developing SpaceX's innovative technologies and in building a strong management team. SpaceX has a long-term vision for the future, and this is inspiring to investors. All of these factors have contributed to the growth of SpaceX's stock price in recent years.

6. Risk

Investing in SpaceX stock is not without risk. The space industry is a risky business, and there is always the potential for accidents or delays. This is reflected in the company's stock price, which can be volatile. For example, in 2016, SpaceX's stock price fell by more than 50% after a rocket explosion. However, the company's stock price has since recovered, and it is now trading at all-time highs.

There are a number of factors that contribute to the risk of investing in SpaceX stock. First, the space industry is a capital-intensive business. SpaceX has to invest heavily in research and development, and it can take years for the company to develop and launch new products. This can put a strain on the company's finances, and it can lead to delays in the development of new products.

Second, the space industry is a highly competitive business. SpaceX faces competition from a number of other companies, both large and small. This competition can lead to price wars and other challenges, which can put pressure on SpaceX's profitability.

Third, the space industry is a regulated industry. SpaceX has to comply with a number of government regulations, which can add to the cost of doing business. These regulations can also delay the development and launch of new products.

Despite these risks, SpaceX is a well-positioned company with a strong track record of success. The company has a number of competitive advantages, including its innovative technologies, its experienced management team, and its strong financial backing. SpaceX is also benefiting from the growing demand for space-based products and services.

Overall, investing in SpaceX stock is a risky proposition. However, the company's strong competitive position and its track record of success make it a potentially rewarding investment.

7. Private

As a private company, SpaceX is not required to disclose its financial information to the public. This makes it more difficult for investors to evaluate the company's financial performance and make informed investment decisions. As a result, SpaceX stock is considered to be a riskier investment than stock in publicly traded companies.

- Limited Financial Data: Private companies are not required to disclose their financial statements to the public. This means that investors have less information to use when making investment decisions.

- Less Transparency: Private companies are not subject to the same reporting requirements as publicly traded companies. This means that there is less transparency into their operations and financial performance.

- Increased Risk: The lack of financial information and transparency makes investing in private companies riskier than investing in publicly traded companies.

Despite the risks, investing in private companies can also be rewarding. Private companies often have the potential to grow quickly and generate high returns. However, it is important to be aware of the risks involved before investing in any private company.

8. Potential

SpaceX's potential for continued growth and success is a key factor in the company's stock price. Investors are betting that SpaceX will be able to capitalize on the growing demand for space-based products and services, and that this will drive the company's revenue and profits higher in the future.

- Innovation: SpaceX is constantly innovating and developing new technologies, such as reusable rockets and spacecraft. These technologies give SpaceX a competitive advantage and allow the company to offer its products and services at a lower cost than its competitors. As SpaceX continues to innovate, it is likely to further increase its market share and drive its stock price higher.

- Market Position: SpaceX is a leader in the space industry, and it has a strong market position. The company has a number of competitive advantages, such as its innovative technologies and its experienced management team. SpaceX is well-positioned to continue to grow its market share in the future, and this is likely to drive its stock price higher.

- Demand: The demand for space-based products and services is growing rapidly. This is being driven by a number of factors, such as the increasing use of satellites for communications and navigation, the growing interest in space tourism, and the increasing demand for space-based resources. SpaceX is well-positioned to meet this growing demand, and this is likely to drive its stock price higher in the future.

- Financial Performance: SpaceX is a private company, so it does not disclose its financial performance to the public. However, there are a number of reasons to believe that SpaceX is profitable and that its financial performance is strong. For example, SpaceX has a number of long-term contracts with NASA and other government agencies, and the company is also generating revenue from its commercial launch services. SpaceX's strong financial performance is likely to continue in the future, and this is likely to drive its stock price higher.

Overall, SpaceX's potential for continued growth and success is a key factor in the company's stock price. Investors are betting that SpaceX will be able to capitalize on the growing demand for space-based products and services, and that this will drive the company's revenue and profits higher in the future.

FAQs about SpaceX Stock Price

SpaceX is a private company, so its stock is not traded on a public exchange. However, there are a number of ways to invest in SpaceX, and its stock price has been on a steady upward trend in recent years.

Here are some of the most frequently asked questions about SpaceX stock price:

Question 1: What is SpaceX stock price?

SpaceX is a private company, so its stock is not publicly traded. This means that there is no single, official SpaceX stock price.

Question 2: How can I invest in SpaceX?

There are a number of ways to invest in SpaceX. One option is to buy shares in a private equity fund that invests in SpaceX. Another option is to buy shares in a venture capital fund that invests in SpaceX.

Question 3: What is the future of SpaceX stock price?

SpaceX's stock price is likely to continue to grow in the future. The company is a leader in the space industry, and it has a number of competitive advantages, such as its innovative technologies, its experienced management team, and its strong financial performance.

Question 4: Is SpaceX stock a good investment?

SpaceX stock is a good investment for those who are willing to take on some risk. The company is a leader in the space industry, and its stock price has been on a steady upward trend in recent years. However, investors should be aware of the risks involved before investing in SpaceX.

Question 5: What are the risks of investing in SpaceX?

There are a number of risks associated with investing in SpaceX. The space industry is a risky business, and there is always the potential for accidents or delays. Additionally, SpaceX is a private company, so there is less information available about its financial performance than there would be if it were a publicly traded company.

Overall, SpaceX stock is a good investment for those who are willing to take on some risk. The company is a leader in the space industry, and its stock price has been on a steady upward trend in recent years. However, investors should be aware of the risks involved before investing in SpaceX.

Please note that the information provided in this FAQ is for informational purposes only and should not be considered investment advice. Investing in SpaceX stock is a risky proposition, and you should always consult with a qualified financial advisor before making any investment decisions.

Conclusion

SpaceX stock price has been on a steady upward trend in recent years, reflecting the company's success in the space industry. SpaceX is a leader in the space industry, and it has a number of competitive advantages, such as its innovative technologies, its experienced management team, and its strong financial performance. The growing demand for space-based products and services is also driving up SpaceX's stock price.

Overall, SpaceX stock is a good investment for those who are willing to take on some risk. The company is a leader in the space industry, and its stock price has been on a steady upward trend in recent years. However, investors should be aware of the risks involved before investing in SpaceX.